B Swaminathan (cbedit@imaws.org)

Rajasthan’s leading bakery association, ‘Rajasthan Bakery Society’, had requested the Central GST Department to revise the tax on Khari snack to 5%. The president of the association, Hardeep S Arora, submitted the request to the representatives of the Central GST Department officers who came to listen and clarify the doubts of the Jaipur food sector during the ‘HoReCa Meet’ organized by Kitchen Herald.

The representation request given by the Rajasthan association reads, “The Maharashtra baking industry has just received a major dose of relief – Khari, the beloved toasted puff pastry snack, will now face a 5% GST instead of the previously threatened 18% rate. This update, emerging from a crucial meeting between the Government’s Department of Goods and Services Tax and the Indian Bakers Federation, answers months of confusion and anxiety for bakery businesses across the state.”

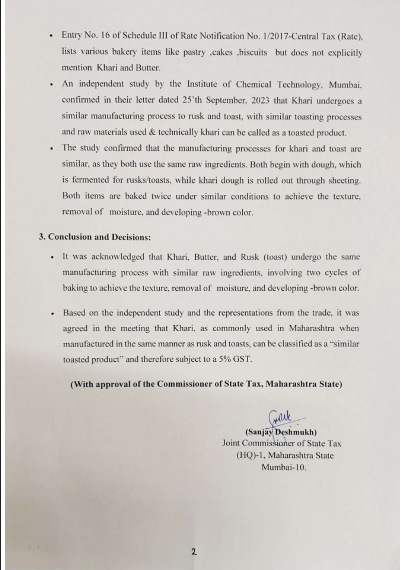

The turning point came at a government meeting held on August 14, 2024, chaired by the Commissioner of State Tax, Maharashtra, where leading officials and Neelkanth Palekar from the Indian Bakers Federation gathered to settle the tax puzzle. The heart of the issue: bakers had been receiving tax notices demanding an 18% GST on their khari products, citing GST FAQs that lumped such items under a higher tax category by interpreting Schedule Entry No. 16 of Schedule III from Rate Notification No. 1/2017.

The Federation wasn’t convinced. They argued that khari, much like toast or rusks, deserved the lower 5% GST, backed by Entry No. 100 of Schedule I of the Rate Notification, which makes “rusks, toasted bread, and similar toasted products” eligible for the favorable tax rate. To counter the ambiguous phrase “similar toasted products,” the bakers called upon science: an independent report from the Institute of Chemical Technology, Mumbai, comparing khari’s production to other toasted goods.

This study broke down the manufacturing process, showing khari shares core ingredients and double-baking methods with rusks and toast, all aimed at achieving that signature dry, crisp texture. The conclusion? Khari fits the bill as a toasted bakery item.

As per the document, after reviewing the evidence, the state tax department agreed that Khari qualifies as a ‘similar toasted product’. The Commissioner’s approval means bakeries can finally breathe easy, putting tax worries behind them and focusing on what they do best: serving up fresh treats.”

This move doesn’t just resolve a technical dispute; it puts money back in the pockets of bakers, sets a precedent, and brings long-awaited clarity to the entire bakery industry in Maharashtra.

Apart from that, the Rajasthan forum, in the discussion with the officers, had requested for ease of taxation. “We [bakers] would like to work closer with the Government. We would request the GST taxation to be simple and supportive. Thus, our fingers are crossed for the new announcements that are about to come as far as the GST is concerned”, Hardeep explained as the major concerns to the officers. Hardeep also explained the other pains of various tax issues for various products in similar categories among the baking products, which often confuses both the bakery owners and the customers.