-Khwaish Hingad (cbedit@imaws.org)

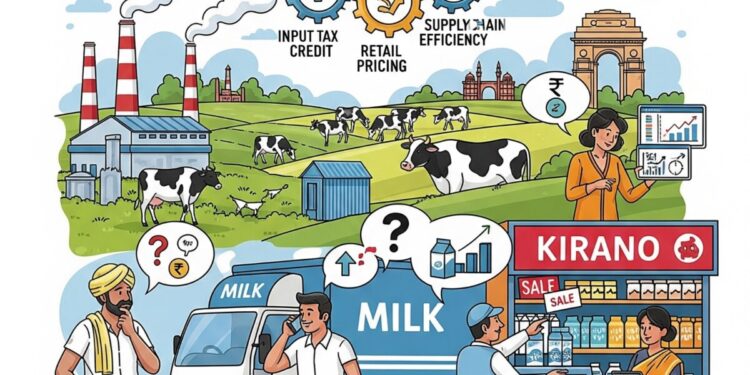

The recent GST changes on milk and milk products have been met with widespread approval from key players in the Indian dairy sector. The government’s decision to eliminate the tax on paneer and reduce it on other staples like ghee and butter is being hailed as a win for consumers and the industry alike. Leaders across the board believe this recalibration will make nutritious, branded products more accessible, stimulate consumption, and strengthen the entire dairy supply chain, from farmers to retailers.

Here’s a deeper look into the industry leaders’ reactions.

Mrs. Bhuvaneswari Nara, Vice Chairperson and Managing Director, Heritage Foods states that these GST reforms will have a broad impact on nearly all Indian households by making essential dairy staples more affordable. She notes that the change will help high-quality, branded products compete more effectively with unregulated producers, thereby building consumer trust.

“The GST recalibration for India’s dairy industry is very welcome and timely. Moving everyday staples like paneer to the 0% slab, and ghee, butter, and cheese from 12% to 5%, will have a broad impact, as these categories touch nearly 100% of Indian households. Not only do these essentials lighten the monthly grocery bill, but the reforms also help high-quality, branded products compete effectively with unorganized and unregulated producers. This shift strengthens formal supply chains, builds consumer trust, and supports more nutritious diets. Dairy products such as paneer, butter, and ghee are staples in every Indian kitchen, yet rising prices have forced many families to switch to cheaper substitutes that lack similar nutritional value.

In light of this, we at Heritage Foods are happy to announce that we shall be passing on the full benefits of these reforms to our consumers, helping boost the festive mood in our markets. We are also working with our partners and distributors to manage the transition smoothly and will be looking to ramp up capacity to capture the expected market expansion. We are also working closely with our distributors and retail partners to manage the transition smoothly and effectively.”

Devendra Shah, Chairman, Parag Milk Foods highlights that the reduction in GST rates will benefit consumers, particularly in price-sensitive rural and semi-urban areas. He also says this move will benefit farmers, as the expected increase in demand will lead to better income stability and encourage investment in their cattle.

“The reduction in GST rates on UHT Milk and Paneer to NIL and dairy products like ghee, butter, cheese from 12% to 5% marks a significant development for the food and FMCG sectors. This move is expected to make these commonly consumed items more affordable, benefiting end consumers, particularly in price-sensitive rural and semi-urban areas.Furthermore, This will also benefit the farmers who are the backbone of this industry. Higher demand will allow farmers a better income stability and the confidence to invest in better cattle care and feed. Over time, this can uplift rural livelihoods, strengthen economy, and ensure that the growth of the organised dairy sector directly translates into a better quality of life for India’s dairy farming families. The lower tax burden could help increase consumption of branded and quality-assured dairy products, potentially encouraging a shift away from unregulated or adulterated alternatives. This rate cut will boost demand across formal dairy channels, offering scope for improved supply chain efficiencies. This GST revision is broadly seen as a step toward making essential nutrition more accessible and promoting formalization in India’s vast dairy ecosystem.”

Yogitha Jahnavi, Founder & CEO, V-Rich describes the GST decisions as a strategic move to promote health and wellness while making essential goods more affordable. She sees this as an opportunity for retailers to rebalance their product portfolios and dedicate more shelf space to nutritious items.

“The latest GST decisions are a strategic move that will fundamentally reshape the Indian retail and consumer landscape. The government’s dual focus on making essential goods more affordable while discouraging unhealthy consumption is a game-changer. The significant reduction of GST on dairy products like paneer and ghee from 12% to 5% is a tremendous boost for both retailers and consumers. It makes these nutritious staples more accessible for Indian families and allows businesses to expand their market reach.

Simultaneously, the new 40% GST on caffeinated and carbonated beverages and an 18% tax on other sugary items sends a clear message: health is a priority. This will naturally push price-sensitive consumers towards healthier alternatives, creating a greater demand for ‘clean-label’ products and healthier snacks. For retailers, this is an opportunity to rebalance their product portfolios, dedicate more shelf space to nutritious items, and educate customers on the benefits of these GST-friendly options. This isn’t just about tax policy; it’s a golden opportunity for retailers to align their business models with a nationwide shift toward health and wellness.”

Thiyagarajan. K, Executive Director, Tamil Milk says that the GST cut on ghee and paneer is a direct benefit for the consumer, as raw material costs for manufacturers have not changed. He also mentions that the reduction of GST on milk cans is a significant help for manufacturers and their farmers.

“The recent GST decisions are a huge win for consumers, directly easing the financial burden on us. I’m a consumer myself, so I can say that with certainty. The GST on ghee has been reduced from 12% to 5%, and for paneer, the 5% GST has been reduced to zero, effective September 22nd. This is incredibly useful for consumers and, for us as manufacturers, it means we can increase sales and penetrate the market more deeply. The benefit of these GST cuts goes directly to the consumer, not the manufacturer, because our raw material costs haven’t changed. From a manufacturer’s point of view, the reduction of GST on stainless steel and aluminum alloy milk cans is a significant help to us and our farmers.

The investment required to buy these cans is now 10% lower compared to last year, which is a major change. This makes us very happy. The reduction in ghee GST is also helping us boost sales, especially with the festive season starting in South India, which ultimately helps us as manufacturers. However, we have a humble request for the government. While paneer—which is a higher-value product—is now tax-exempt, curd and buttermilk still have a 5% GST. The consumption of curd is much higher in India than paneer because it’s an everyday staple, and buttermilk is a product that even the poorest people can afford. We hope the government will consider reducing or eliminating the GST on curd and buttermilk as well, as it would be a very good thing and highly beneficial for consumers.”