– KH News Desk (cbedit@imaws.org)

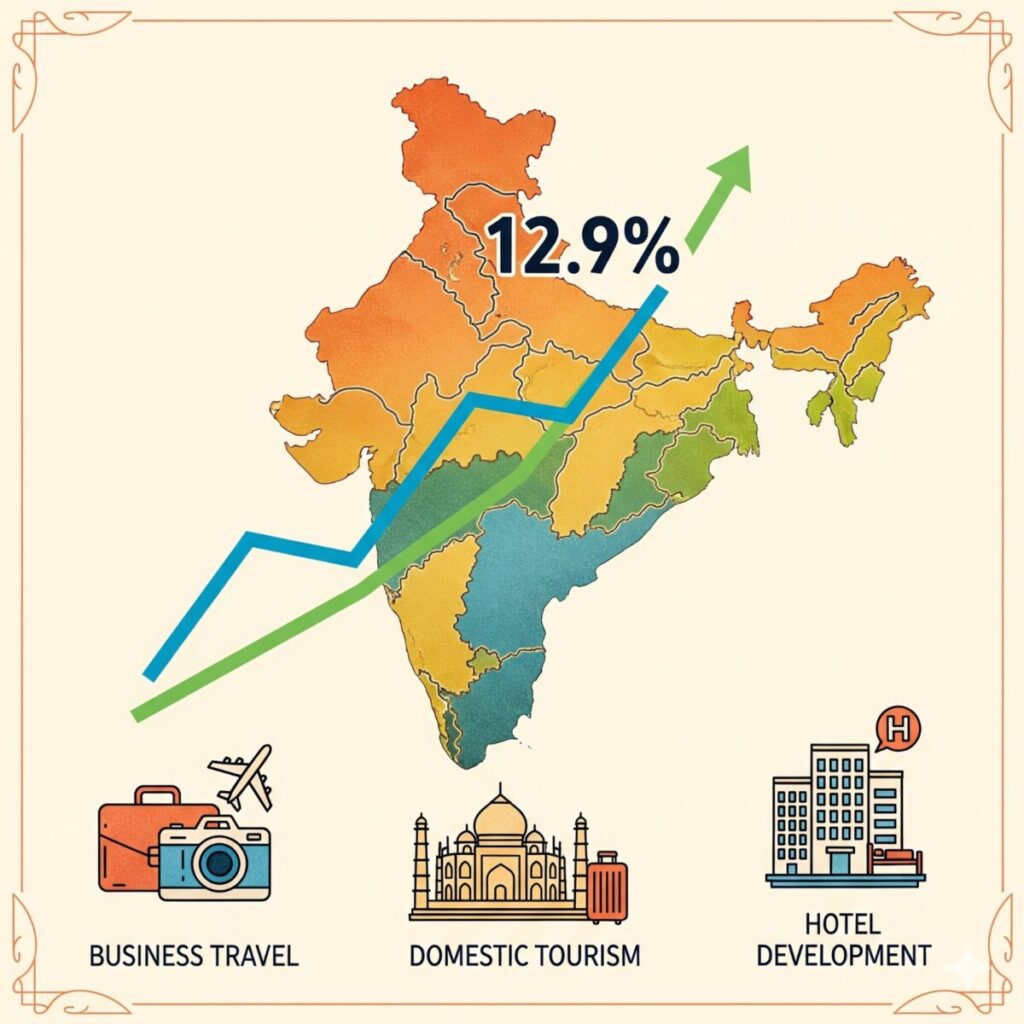

India’s hospitality sector is showing strong signs of recovery and growth, with a remarkable 12.9% year-on-year rise in Revenue per Available Room (RevPAR) in the second quarter of 2025, according to JLL’s Hotel Momentum India (HMI) Q2 2025 report. Quickening pace from the prior quarter, RevPAR also rose by 10% sequentially, reflecting sustained momentum across markets.

Emerging as the standout performer, Bengaluru recorded a staggering 29.4% RevPAR increase during April–June 2025, thanks to strategic rate optimisation and rising occupancy paired with higher Average Daily Rates (ADR). The city’s dual-engine growth—boosted pricing and fuller rooms—positions it as the hospitality market to watch.

Hyderabad also posted strong performance, with ADR climbing 18.6% year-on-year. The city’s progress is credited to growing corporate travel and active investment flows. Meanwhile, Chennai, Delhi, and Mumbai held steady amid diversified demand from corporate clients, government-related travel, and the leisure segment. Summer tourism and official events provided needed support to occupancy in these metros.

On the development front, investor confidence is clearly on the upswing. In Q2 2025 alone, the sector witnessed 106 hotel signings, translating into 13,398 new keys—an impressive tally signaling robust long-term growth expectations. Much of this activity is in the midscale and emerging market segments, underscoring a clear shift toward scalable, value-oriented development.

Roopa George, Senior Vice President of JLL’s Hotels and Hospitality Group in India, noted that while occupancy has stabilised across many markets, it is healthy ADR growth that’s driving the double-digit RevPAR surge. She also highlighted increasing consolidation and partnerships focused on scale and efficiency.

Taken together, these trends paint a picture of a hospitality industry that is not only rebounding but doing so in a strategic and sustainable manner.

Performance Trends and Drivers

The 12.9% YoY RevPAR gain marks a notable improvement over the same period in 2024. Q2 2025’s sequential 10% increase—when compared to Q1—suggests sustained demand and tactical pricing maneuvers are paying off.

City Highlights

- Bengaluru: At the forefront, Bengaluru’s 29.4% RevPAR leap stems from rising ADR and occupancy working hand in hand.

- Hyderabad: ADR gains of 18.6% reflect heightened corporate activity and investor appetite.

- Metro Resilience: Chennai, Delhi, and Mumbai maintained performance across corporate, government, and leisure segments, proving these hubs remain vital demand drivers amid broader national recovery.

Investment and Development Trends

- Signings & Keys: The quarter’s 106 hotel signings adding 13,398 keys signals investor optimism in India’s long-term hospitality outlook, particularly in cost-efficient segments.

- Midscale Momentum: Activity concentrated in midscale and emerging markets indicates the industry is pivoting toward more scalable and accessible offerings,

- Strategic Partnerships: Consolidations and alliances are reshaping the development landscape, with efficiency and scale emerging as central themes, according to JLL’s Roopa George.

Why This Matters

- Investor Confidence: The development activity—over 13,000 hotel keys signed in one quarter—reflects strong investor trust in the Indian hospitality sector’s resilience and future growth.

- Balanced Recovery: The blend of urban stronghold performance and midscale expansion suggests growth isn’t limited to luxury markets, but spans across segments.

- Strategic Advantage: Cities like Bengaluru and Hyderabad are leveraging optimized rates and demand flows to gain competitive edge and deliver standout recovery.

Looking Ahead

Industry fundamentals appear solid enough to support continued growth. Demand is diversified across leisure, corporate, and government segments, while strategic pricing and rate optimization seem poised to sustain RevPAR gains. The investment pipeline especially in mid-segment hotels hints at deeper market maturation and geographic expansion.

In essence, the hospitality sector is not merely rebounding it’s redefining its growth trajectory through smarter segmentation, strategic alignment, and investor-driven expansion.