BEST WISHES ZAAROZ FROM

AND

-Khwaish Hingad (editorial1@imaws.org)

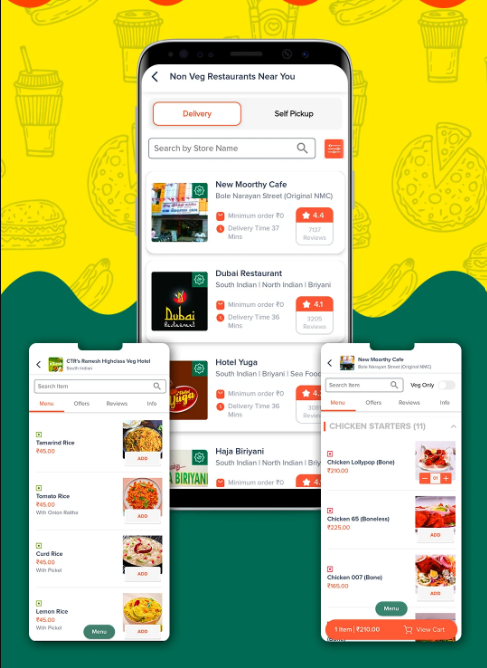

Tamil Nadu based New-age Q-commerce company Zaaroz is the hottest entry into the food delivery space and is trending not just among customers, but also among the restaruarant owners. While netizens often cribble on the fluctuating prices of food items on the two major online delivery players, this start-up Zaaroz aims to bring customers closer to the restaurants.

The delivery app has been trending following an announcement by Tamil Nadu Hotel Association’s recent announcement to boycott US products. The news has created an unexpected windfall for homegrown food delivery platform Zaaroz, as the company rides the wave of regional nationalism to challenge the duopoly of two players in India’s ₹43.47 billion online food delivery market.

In an exclusive interview, Jayasimhan Vijayaraghavan, Co-Founder & Chief Information Officer of Zaaroz, revealed how the Tamil Nadu Hotel Owners Association’s support has accelerated the company’s growth trajectory across the state, positioning the platform as a viable alternative to commission-heavy giants that charge restaurants 15-30% per order.

The Anti-Commission Revolution

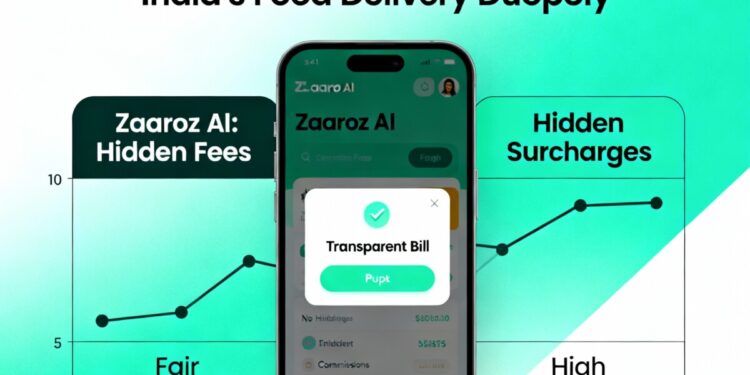

While the other two leading delivery apps continue to face criticism for hidden charges that can inflate food prices by up to 81%, Zaaroz has built its business model around transparency and fixed subscription fees. “Our subscription model benefits restaurants more compared to the previous commission-based model,” Jayasimhan explained during the interview. “Restaurant partners know exactly how much they have to pay upfront monthly, with no hidden charges or penalties.”

This approach addresses a persistent pain point in the industry. Research shows that traditional food delivery platforms often charge customers significantly more than restaurant prices, with delivery fees, platform charges, and surge pricing creating a complex web of costs. Zaaroz promises customers will see exactly the same price in the app as they would in the restaurant.

Political Tailwinds Fuel Growth

The timing couldn’t be better for Zaaroz. Tamil Nadu’s hotel association announced a boycott of US beverages like Pepsi and Coke in early September 2025, while simultaneously supporting local alternatives. “The restaurant association in Tamil Nadu is supporting us a lot and they have planned to onboard us across Tamil Nadu because our subscription model is a huge hit,” Jayasimhan noted.

This regional backing has opened doors to partnerships with “thousands of local eateries and mid-size restaurants,” accelerating Zaaroz’ expansion plans across the state. The company expects to cover entire Tamil Nadu within 3-6 months, including Tier-1 cities, before expanding to other southern states.

David vs. Goliath: The Tier-2 Strategy

Unlike the most famous online players which focus heavily on metropolitan markets, Zaaroz has deliberately targeted Tier-2 and Tier-3 cities. “We operate mainly on tier 2 and 3 markets. That’s what we have been doing in the past. This strategy addresses an underserved market segment while avoiding direct competition with established players in major cities”, he revealed.

The company initially faced challenges in 2019 when awareness about online food delivery was low in smaller cities. “We had to do a lot of groundwork, meet restaurants face-to-face, explain the benefits, and train them on app operations,” the CIO recalled. However, the pandemic-driven digitization has eliminated most of these barriers.

Technology Integration and AI Adoption

Despite its focus on transparent pricing, Zaaroz is not ignoring technological advancement. The company has already implemented AI in catalog management and has developed a comprehensive roadmap for the next 2-3 years. “We have use cases laid out for route optimization and data engineering,” he confirmed, positioning the platform to compete on efficiency as well as cost.

The main technical challenge now lies in integrating with different point-of-sale systems across regions. “Each region has a different point-of-sale system with different architecture and approaches. We spend time on integration as we expand,” he explained.

Market Disruption Through Cooperation

Zaaroz positions itself as implementing a “cooperative model” where all stakeholders benefit, contrasting with what Jayasimhan calls the unsustainable “deep discount” approach of competitors. The company collects delivery fees from customers and passes them entirely to delivery partners, maintaining transparency throughout the value chain.

This model appears to be gaining traction. With India’s online food delivery market expected to grow at a CAGR of 22.25% until 2033, reaching ₹265.12 billion, there’s significant room for alternative players that can differentiate on pricing and transparency.

Expansion Beyond Tamil Nadu

The company’s immediate focus remains on capturing the entire Tamil Nadu market before expanding to neighboring states. “Once Tamil Nadu is done, we will focus on the south of India – Andhra, Telangana, Karnataka, and Kerala,” he outlined. Zaaroz is also exploring collaborations with state-level restaurant associations in neighboring states to replicate its Tamil Nadu success story. “We are open to discussions to build similar cooperative models in other states,” he added.

Industry Impact and Future Outlook

The rise of Zaaroz represents a broader trend toward transparency and fair pricing in India’s food delivery ecosystem. As traditional platforms face increasing criticism over hidden charges and high commission rates, subscription-based models may gain more acceptance among both restaurants and consumers.

The company’s success in Tamil Nadu, particularly during a period of anti-US sentiment and support for local alternatives, demonstrates how regional politics and business strategy can intersect to create market opportunities. Whether this model can scale beyond Tamil Nadu’s unique political environment remains to be seen, but early indicators suggest strong potential for sustainable growth in underserved markets.

For an industry that has long been dominated by two major players, Zaaroz’ transparent pricing model and strategic regional focus could herald a new era of competition in India’s rapidly expanding food delivery market.