-KH News Desk (editorial1@imaws.org)

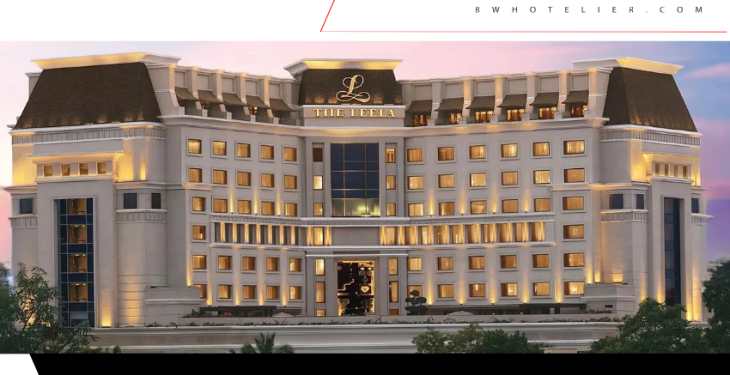

The Leela Palaces, Hotels & Resorts Limited (formerly Schloss Bangalore Limited) has announced its comprehensive financial and operational results for the quarter concluding September 30, 2025 (Q2 FY26), revealing a period of robust growth and strategic portfolio enhancement, which includes its highly anticipated first international foray.

Financial and Operational Excellence

The company showcased strong momentum, with Total Revenue increasing by 11% year-on-year to reach ₹3,334 million (₹333.4 crore). EBITDA saw a significant rise of 17% to ₹1,607 million (₹160.7 crore), and Profit After Tax (PAT) grew to ₹747 million (₹74.7 crore). This achievement marks the company’s fourth consecutive quarter of positive PAT, underscoring the strength and efficiency of its business model.

EBITDA margins expanded to 48.2%, primarily driven by improved operating leverage and enhanced cost management strategies. The operational performance was robust, with the same-store portfolio delivering strong operating leverage and a 77% flow-through to EBITDA for H1 FY25-26.

Key operational metrics also reflected industry-leading performance, with RevPAR (Revenue Per Available Room) growing 13% to ₹13,262, fueled by both higher occupancy and growth in Average Daily Rate (ADR). The company highlighted that its owned hotels posted strong double-digit RevPAR growth across both city and resort segments, demonstrating customers’ continued willingness to pay a premium for The Leela experience, which is reflected in a best-in-class Net Promoter Score (NPS) of 86.

Anuraag Bhatnagar, Chief Executive Officer, commented on the results, stating: “We delivered a robust performance in Q2 FY26… We remain on track to deliver mid-to-high teens EBITDA growth for FY26, supported by robust operating momentum, strategic initiatives, and continued portfolio enhancements.”

Pioneering International Foray into Dubai

A major announcement accompanying the Q2 results is the company’s first foray into the international market. The Leela has received board approval to sign binding agreements to acquire a 25% equity stake in a luxury beachfront resort situated in Dubai’s iconic Palm Jumeirah, a top luxury tourist destination.

Private funds managed by Brookfield will acquire the remaining 75% stake in the resort. The Leela’s 25% equity stake will require an upfront capital investment of approximately $49 million (equivalent to ₹437 crore). Upon its conversion to “The Leela,” this resort will officially mark the brand’s international debut.

The expansive resort is spread across 23 acres on one of the largest freehold beachfront land plots in Dubai. It is a large-scale development comprising 546 keys, which includes a 361-key hotel, 182 residences, and three exclusive villas.

Strategic Portfolio and Capital Allocation

The Leela currently operates a portfolio of 13 properties with a total of 3,544 keys across 11 cities in India, comprising five owned, seven managed, and one franchised hotel. The company is poised for significant expansion, with a pipeline of nine hotels, putting it on track to expand to 22 properties over the next three years in high-growth markets including Agra, Ayodhya, Bandhavgarh, Mumbai, Ranthambore, Sikkim, Srinagar, and now, Dubai.

Furthermore, the company announced a strategic restructuring concerning its Mumbai BKC mixed-use development. Leela BKC Holdings Private Limited will seek regulatory approvals to demerge the office business. Under this revised structure, The Leela will retain and fund a 50% stake in the hotel component, while Brookfield will fund the remaining 50% of the hotel and fully fund and own the 0.7 million square feet office space. This strategic demerger enables The Leela to sharpen its focus on the hotel business and optimize capital allocation towards more accretive investment opportunities.

Enhanced Financial Flexibility

The company continues its post-IPO balance sheet strengthening, with net debt to Last Twelve Months (LTM) EBITDA standing at a low 0.5x, providing substantial financial flexibility for future growth initiatives. Enhanced financing efficiency and strategic refinancing efforts have further strengthened its liquidity position, resulting in a reduced cost of debt to 8.4% (down from 9.1%) and an upgraded credit rating to AA (Stable).