NEW YEAR WISHES FROM

-Niharika Naik | IMAWS (cbedit@imaws.org)

The travel sector has undergone herculean transformations in a post-pandemic scenario. Taking stock of prior learnings from the past two to three years, and predicting how future trends will shape the hospitality industry is imperative. Reimagining food and beverage servicing, rising demands in alternative accommodation, distribution of manpower, reduction in carbon footprints, and investment outlooks are few of many concerns.

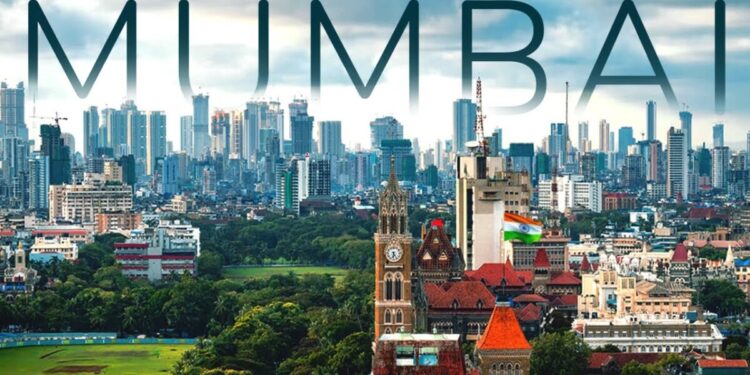

Challenges plaguing hoteliers are not few and far between. “Budget hotels suffered a lot in pre-COVID days. The rise of certain hotel entities led to unethical business practices among the online aggregating industry players,” says Mr. Ashraf Ali, President of Budget Hotels Association (BHA), Mumbai.

Mr. Ashraf initiated the formation of Hotel Association Confederation Pan India, responsible for a movement to quit aforementioned unprincipled businesses . “Almost 70% of such hotels attempted to harass hoteliers in court, reducing room rates, resorting to encouragement of amoral activities. COVID was responsible for ending this blackmail. Post pandemic, budget hoteliers running rented properties suffered huge setbacks, but those that survived are doing rather well,” shared Mr. Ali candidly.

The survival of international recession periods and revival of business opportunities and tourism makes India a hospitality stalwart. The subcontinent is a vibrant of hotel owners, digital experts, investors, travel experts, and policy makers.

The hospitality sector in India has been one of the fastest-growing economic segments in the country, making a substantial contribution to its GDP and employment figures. “In the fiscal year 2023 – 2024, India welcomed around 13 billion international tourists, generating a remarkable $30 billion in Foreign Exchange Earnings” (FEE), stated Mr. Pradeep Shetty, President, Hotel And Restaurant Association (Western India) (HRAWI).

Statistics suggest Mumbai Hotel rates were at an exponential high with rooms at 5 star establishments near Wankhede Stadium going for Rs. 90,000 per night. Hoteliers capitalised on this major event experiencing about 80% surge prices. Even two – three star hotels increased base costs to around Rs. 5,000 – Rs. 18,000 per night.

“There’s an uptick in dining out as spectators look for places to eat and socialise before, during, and after games. This often leads to a rise in profits for F & B joints. Beyond the sporting event itself, host cities become major tourist hubs. An influx of tourists means increased activities like sight-seeing, shopping, and entertainment too,” remarked Mr. Pradeep Shetty, President, (HRAWI).

Not only the hospitality industry, but also local economies benefit from such arrangements. An infusion of capital results in job creation across various related sectors like transportation and retail. Moreover, MICE or Meetings, Incentives, Conferences and Exhibitions drive ancillary tourism such as medical tourism, eco-tourism, cruise tourism, and the like.

In addition, family holidays and recent G20 preparations present enormous opportunities for hoteliers, with special rules to boot. “We put in our request to the police department for an extension of operating hours till 5AM on 24th December and 31st December so patrons can bring in Christmas and New Year’s,” stated Mr. Sudhakar Shetty, General Secretary, Indian Hotel and Restaurant Association (AHAR).

In light of 2024, hoteliers rely on consumer data to guide their future plans. “We have already requested team members to prepare for the new year. Past consumption trends and clear feedback received from travel agencies informs us of a surge in hotel bookings,” remarked Mr. Ashraf Ali, President, (BHA).

Pune is no longer a laid back town. Its rapid transformation into the second largest town in Maharashtra impacts its hospitality sector tremendously. How does the industry function differently here, as compared to metropolitan Mumbai?

“Mumbai tends to have slightly higher prices, around 20% more in terms of accommodation in star hotels, as compared to Pune. These rates apply to both restaurants and bars as well. While both Mumbai and Pune hold the pride of the State, Mumbai has a wider audience for leisure. Pune, on the other hand, is driven by business, IT, manufacturing, and the pharmaceutical industry,” elucidated Mr. Amit Sharma, President, Poona Hoteliers Association (PHA). Pune hotel associations prove instrumental in liasoning with government agencies for betterment of infrastructure and nearby destinations and forts to ensure a stream of tourists.

With 2024 upon us, hotel associations hope their long-pending request of Infrastructure Status be granted to the hospitality sector. Speciality status ensures access to long-term funds under the RBI lending norm criteria. “Industry status has been accorded to tourism and hospitality by many State Governments, however, the incentives and privileges associated have not been conferred. Tourism and hospitality must be placed on the concurrent list of the Indian Constitution, making it a national agenda,” wisely stated Mr. Pradeep Shetty, President, (HRAWI).

With 2024 upon us, hotel associations hope their long-pending request of Infrastructure Status be granted to the hospitality sector. Speciality status ensures access to long-term funds under the RBI lending norm criteria. “Industry status has been accorded to tourism and hospitality by many State Governments, however, the incentives and privileges associated have not been conferred. Tourism and hospitality must be placed on the concurrent list of the Indian Constitution, making it a national agenda,” wisely stated Mr. Pradeep Shetty, President, (HRAWI).

The future of Mumbai and Pune Hotel Associations remains undoubtedly bright. However, measures to control industry damage caused by Online Travel Aggregators (OTAs) and Food Service Aggregators (FSAs) must be mitigated. Instituting ex-ante regulations, identifying market issues in advance, shaping stakeholder behaviour, and regulatory measures are possible positive interventions.

BEST WISHES FROM